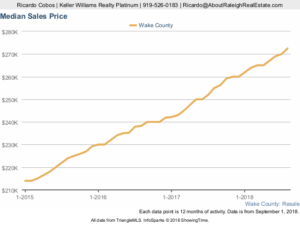

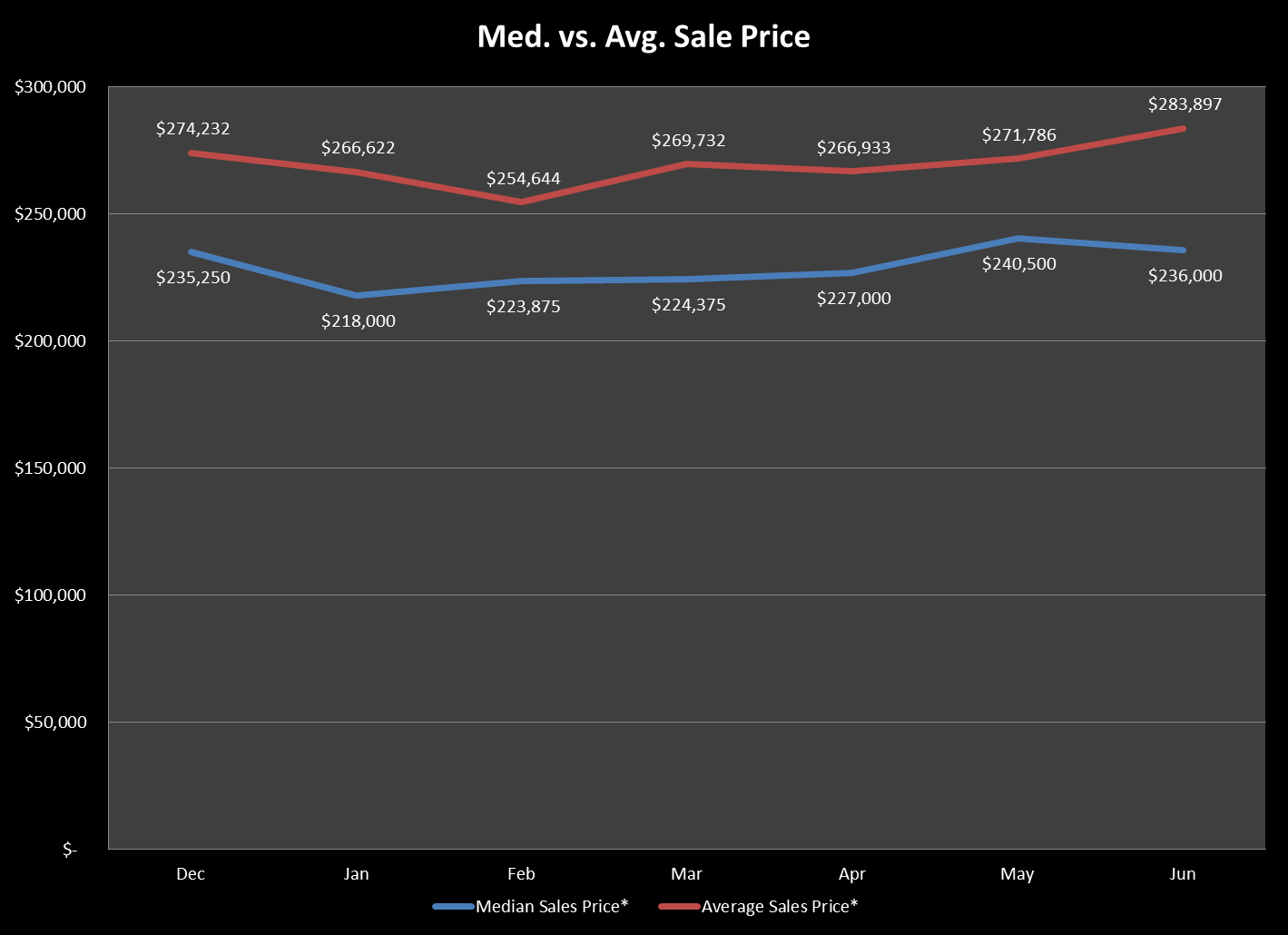

The cost of buying a home is rising three times faster than the cost to rent

This was today’s top story in my real estate news feed from Marketwatch.com ‘The monthly cost of buying a home – which includes mortgage payments, taxes and insurance – jumped 14% between July 2017 and July 2018, according to a …

The cost of buying a home is rising three times faster than the cost to rent Read more »