Conventional 3% Down Mortgages 27 FAQ’s

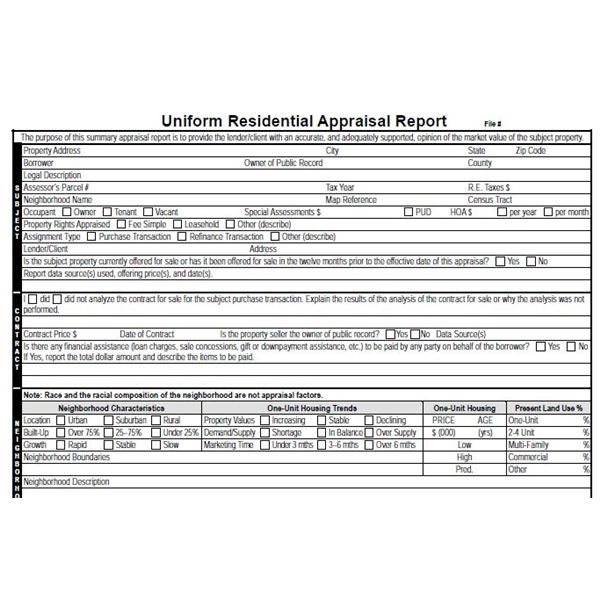

Frequently Asked Questions and Answers to the new Conventional 97% Mortgage. Is the Conventional 97 a government-backed mortgage program? Yes, the Conventional 97 mortgage program is backed by the government. It’s offered via Fannie Mae only. The program is not …